According to a survey, more than 30% of businesses have made errors in their bank reconciliations due to manual data entry. If these errors are not corrected in time, they can lead to bigger problems during tax filing procedure. In this article, we will introduce the bank reconciliation format and discuss the process of bank reconciliation, the significance of reconciliation statement and common errors.

Don't want to do manual reconciliation? To reduce the cost of reconciliation for merchants, KPay has introduced two powerful auto-reconciliation features to speed up reconciliation, minimise manual errors, and improve accounting efficiency. Be sure to read till the end for details and special offers!

Bank reconciliation is the process by which a business ensures that its accounts are correct by comparing its accounting books with its bank statement. This helps a business identify the reasons for discrepancies, such as a dishonored check or a manual error, and make adjustments to the accounts.

- Ensure correct financial information: Regular bank reconciliations help correct accounting errors and keep financial data accurate.

- Prevent fraud: Bank reconciliations can reveal potentially unusual transactions and help organizations detect potential fraud in a timely manner.

- Improve tax payment efficiency: Accurate bank reconciliations can speed up the tax audit process and prevent overpayment or omission of taxes.

- Optimise business operations: Clear account balances and transaction details help business decision makers make better financial plans.

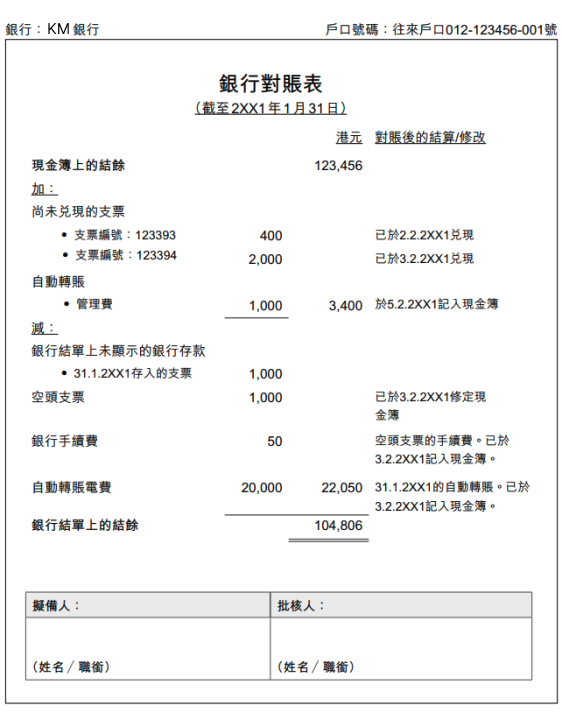

A bank statement is a summary of the results of a comparison of monthly bank statements and cash books. A standard bank statement should include the following elements:

- A list of the balances between the bank statement and the business cash book.

- Compare the differences between the bank statement and the business cash book.

- Explain where and why there are discrepancies, such as checks not cashed, bank fees, and outstanding deposits.

Common errors in bank reconciliations:

- Manual recording errors: Human input errors or missing entries.

- Undelivered deposits: Enterprises have made cash book entries, but the bank has not yet reflected this deposit.

- Uncashed checks: A check has been deducted, but the supplier has not cashed it and the bank has not deducted the amount.

- Untimely transactions: Deposits or checks that have not been recorded, resulting in a balance difference.

- Bank handling charges: Handling charges that are automatically deducted by the bank and need to be recorded in the enterprise's books.

- Bank posting errors: technical or procedural errors on the part of the bank, which need to be corrected with the bank.

Bank reconciliation template (Chinese only):

- Time-consuming

According to market research data from 278 merchants interviewed by KPay, over 55% of merchants reported that monthly reconciliation took a lot of time. Reconciling sales records, vendor payment records and bank statements alone takes more than 60 hours a month. Merchants also said that it took an average of 30 hours per month to perform daily bookkeeping.

- High administrative costs

In addition to bank reconciliations, many SMEs also need to perform other types of reconciliations and bookkeeping, such as POS system and sales record reconciliations. According to KPay's research data, merchants spend an average of 121 hours per month to process all kinds of bookkeeping and reconciliation, and the operating cost of reconciliation and bookkeeping has already exceeded HKD 100,000!

- Prone to manual errors and omissions

SMEs are prone to errors and omissions when they do their own bookkeeping and reconciliations. According to KPay, more than 50% of the merchants have made mistakes due to manual reconciliation. When the number of accounts that need to be reconciled is large, and the transactions are not only cumbersome but also need to be handled manually, the likelihood of manual error or omission of accounts will naturally increase.

- Lack of professional knowledge

SMEs have limited manpower and may not have accounting staff specialised in reconciling and processing bills. Bosses or employees have to learn a lot of subject knowledge from scratch when they need to reconcile accounts or carry out daily bookkeeping, which consumes a lot of time and administrative costs!

To reduce the cost of merchant reconciliation, KPay has introduced two powerful auto-reconciliation features to speed up reconciliation, minimise manual errors, and increase the efficiency of accounting processing.

POS system auto reconciliation

For merchants using specific POS systems, KPay provides automatic reconciliation function. Merchants simply upload their POS system sales data to the KPay backend, and the system will automatically match the sales data with the transaction history of your KPay smart POS cash register. All reconciliation results can also be viewed through the KPay App, allowing merchants to keep track of the reconciliation status at all times. This helps you to ensure the accuracy of your data and avoid manual errors.

Automatic reconciliation of sales records

KPay App provides automatic reconciliation of KPay account and KPay Smart POS Terminal purchase records, which completely changes the tedious process of traditional manual reconciliation. Merchants can now click “Check Settlement Details” in the transaction records of their KPay account to check the detailed transaction details, eliminating the need to check the paper transaction receipts one by one, which greatly saves time and effort.

New merchant offer: New KPay merchants can enjoy HKD 0 handling fee for the first HKD 30,000 transaction amount, and up to HKD 17,964 additional privileges*!

Free auto-reconciliation: Merchants no longer need to spend a lot of time on reconciliation, which shortens the reconciliation cycle and greatly improves accounting efficiency. Auto Reconciliation reduces the risk of manual input errors and ensures accurate and consistent transaction data.

Simplified operation: KPay App provides one-click access to all postings and transaction details, eliminating the need for tedious manual reconciliation and making financial management easier and more convenient.

Try KPay's payment solutions and enjoy the convenience of fast payment collection and automatic reconciliation, which reduces the burden of daily reconciliation and allows you to focus on business growth!

*Terms and conditions apply

Click 'Started now' below to connect with us and learn more!